how are 457 withdrawals taxed

However distributions from a ROTH 457 plan are not subject to tax withholding. Example 1 shows that amounts deferred are taxable under the 457 f plan when they become vested and include earnings calculated through to the date of vesting.

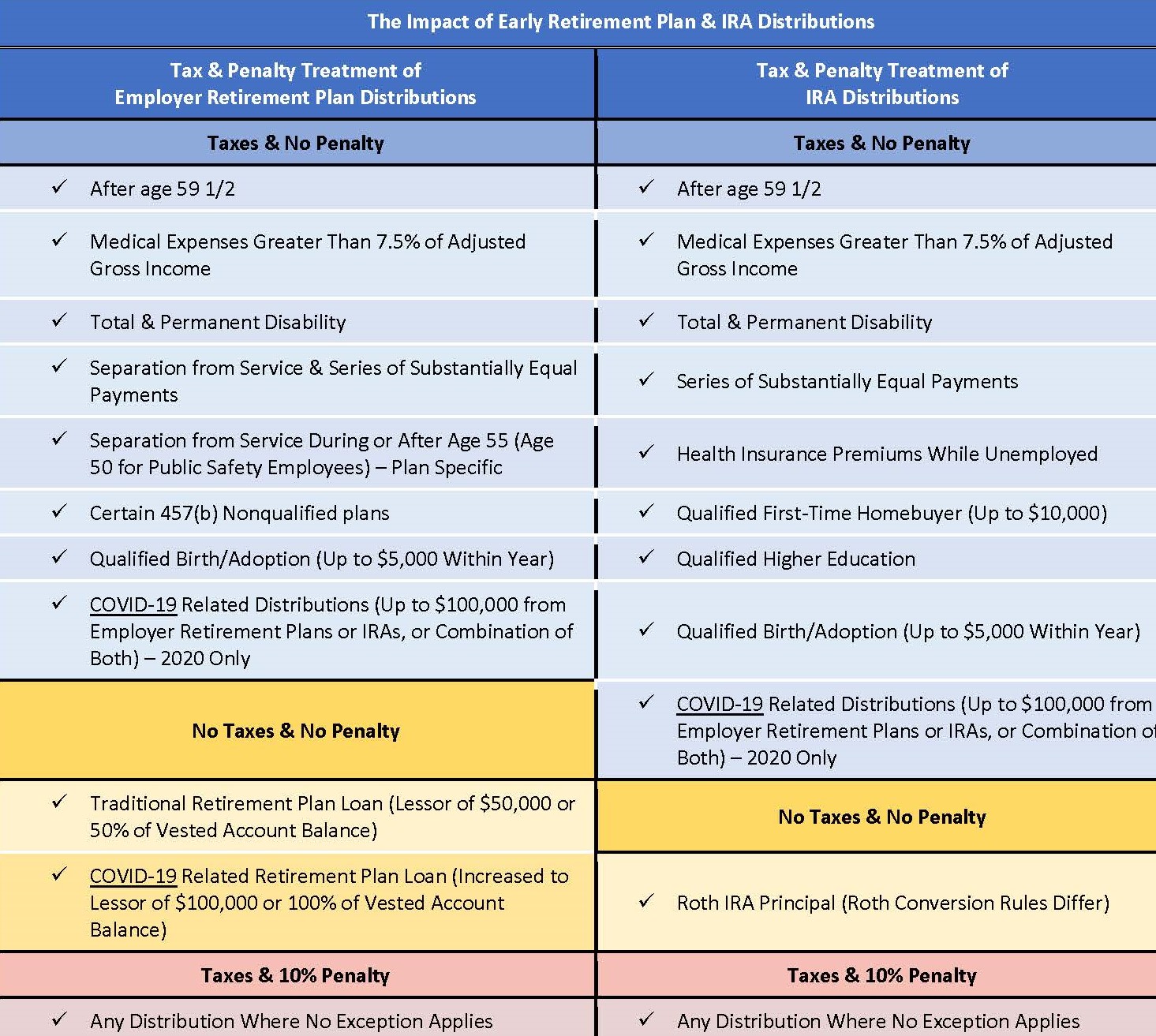

Accessing Retirement Funds Early During Covid 19 Triage Cancer Finances Work Insurance

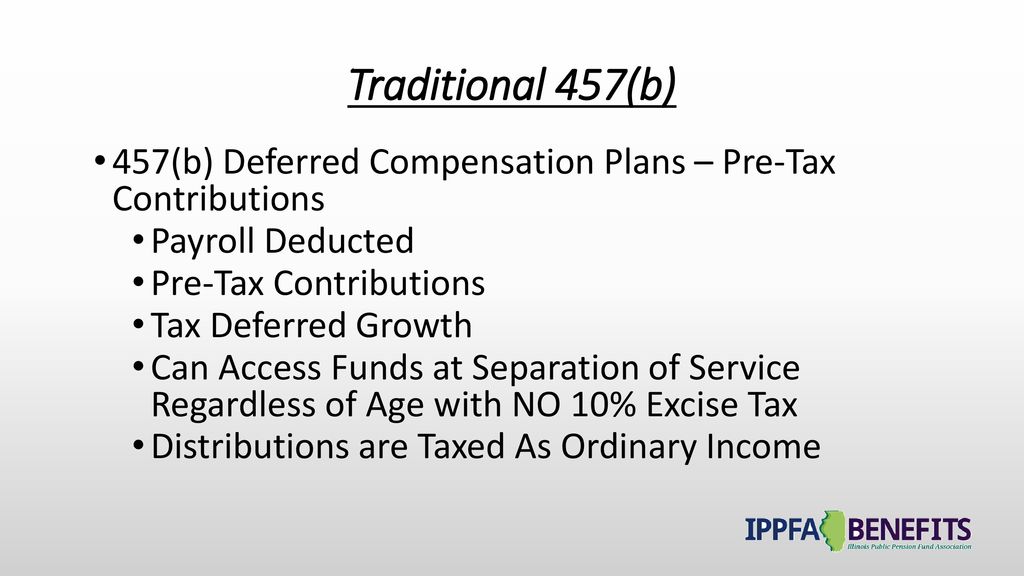

The only difference is there are no withdrawal penalties and that they are the only.

. However you will have to pay. However distributions from a ROTH 457 plan are not subject to tax withholding. See 353405-1T QA-23.

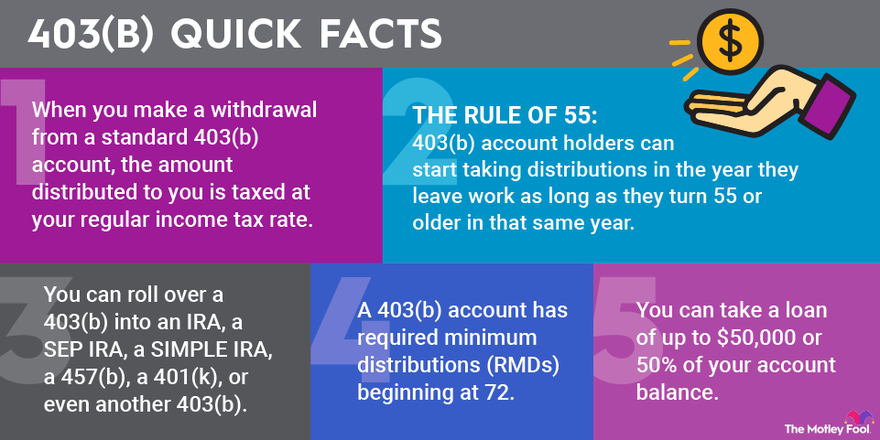

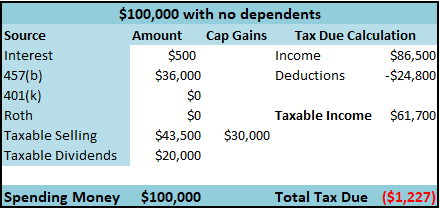

457 plans are taxed as income similar to a 401 k or 403 b. Withdrawals from 457 retirement plans are taxed as ordinary income. How is 457b taxed.

If you have a 457 plan and you die your beneficiary can take distributions from the plan immediately. 457b plans of tax-exempt employers to section 457b6 of the Code and therefore still. See Section IV of this notice for provisions regarding income tax withholding on.

Availability of statutory period to correct plan for failure. Also 457 plan participants are. Here is a list of the key rules.

457 plans are taxed as income similar to a 401 k or 403 b. Withdrawing 1000 leaves you with 710 after taxes 457 Plan Withdrawal Calculator Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan. How much tax will be taken out of my 457 withdrawal.

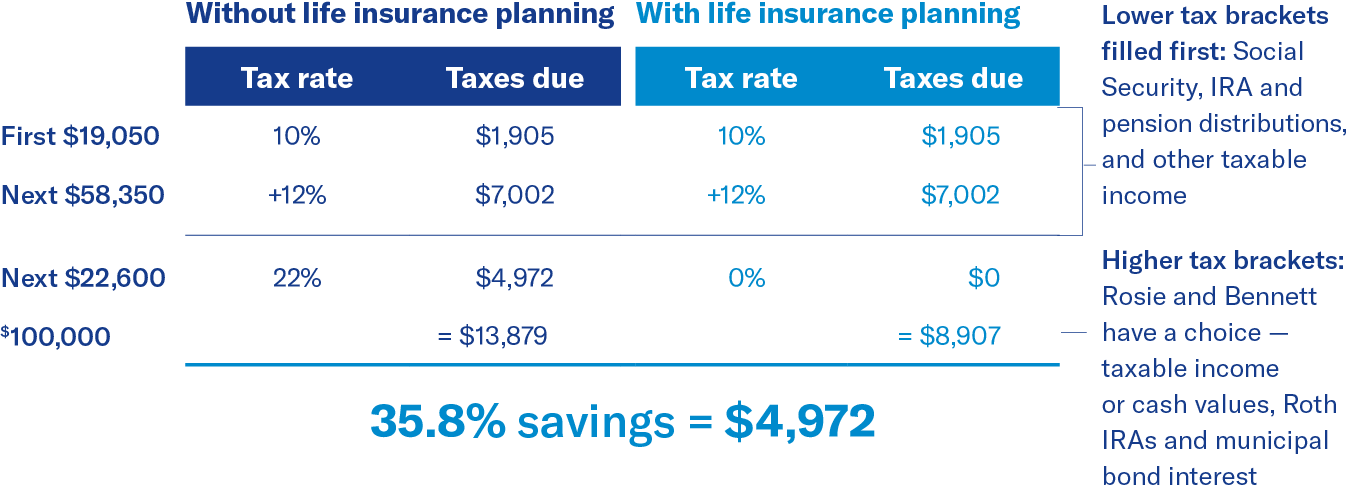

But any additional income such as from retirement account withdrawals that pushes you over the 40525 threshold would be taxed at. 457 plans are taxed as income similar to a 401 k or 403 b when distributions are taken. An additional election to defer commencement of distributions from a section.

3405 do not apply to distributions from a tax-exempt employers 457b plan. The amount you wish to withdraw from your qualified retirement plan. Beneficiary distributions avoid the early withdrawal penalty of 10 percent.

The entire amount in your account is considered taxable upon your separation from service. The entire amount in your account is considered taxable upon your separation from service. For this calculation we assume that all contributions to the retirement account.

How much tax do you pay on a 457 b withdrawal US federal tax law requires that most distributions received under state 457 b plans that do not transfer directly to an IRA or. Rollovers to other eligible retirement plans 401 k 403 b governmental 457 b IRAs No. Tax Implications You are permitted to withdraw money from your 457 plan without any penalties from the Internal Revenue Service no matter how old you are.

All distributions from IRAs 401 ks 403 bs and 457 accounts are subject to income taxes at ordinary income tax rates. Both governmental and non-governmental 457 b plans fall under the IRS required minimum distribution RMD rule that says you must begin withdrawing a specified portion of. If you take an eligible rollover distribution from your governmental 457 b plan the government will withhold 20 of the distribution for.

How is 457b taxed. Your highest marginal tax bracket is 12. Withdrawals from 457 retirement plans are taxed as ordinary income.

Withdrawals are subject to income tax.

Do You Have To Claim Retirement Plan Monies On Federal Income Taxes

457 B Deferred Compensation Plan Basics Ppt Download

457 Vs Roth Ira What You Should Know 2022

Using Life Insurance To Help Minimize Taxes In Retirement

How To Access Retirement Funds Early

403 B Withdrawal Rules For 2022 The Motley Fool

457 And Roth 457 Page 2 Focus Financial

Everything You Need To Know About A 457 Real World Made Easy

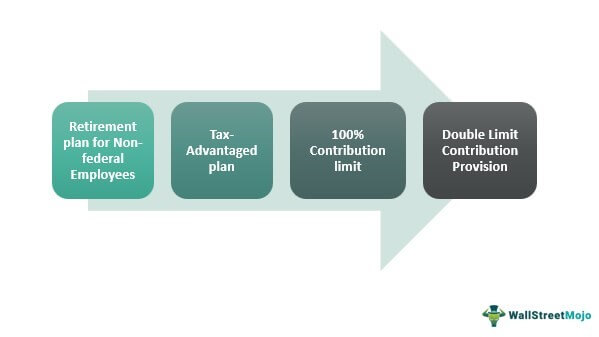

457 Plan Meaning Retirement Plan Benefits Limits Vs 401k

How To Withdraw From Ira Accounts At 60 Years Old Sapling

457 Plan Withdrawal Calculator

The Tax Cuts Jobs Act Makes Roth Ira Conversions More Favorable Burton Enright Welch

Irs Form 1099 R Box 7 Distribution Codes Ascensus

What Is A 457 B Plan Forbes Advisor

The Taxman Leaveth 2021 A No Tax Early Retirement Physician On Fire

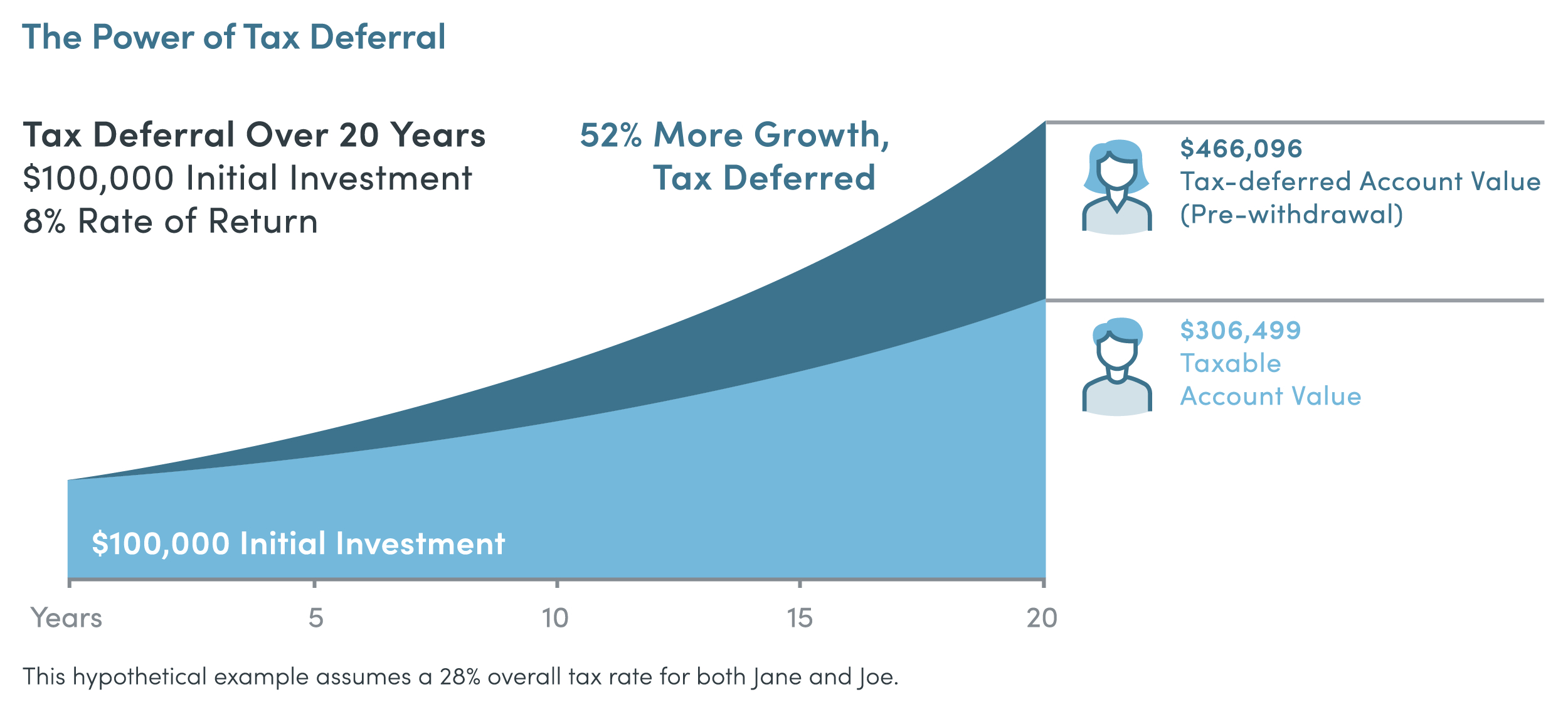

How Tax Deferral Works Securitybenefit Com